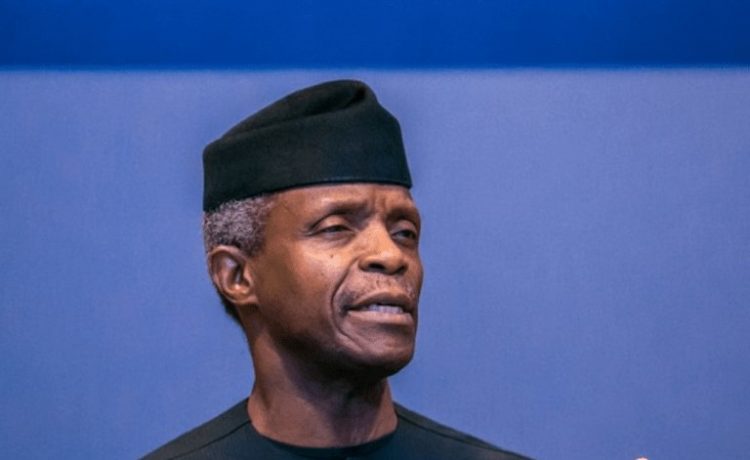

Vice President Yemi Osinbajo, has faulted the prohibition of cryptocurrencies in the country, saying it should rather be regulated.

He was speaking at a one-day Special Summit on the Economy organised by the Central Bank of Nigeria (CBN) in collaboration with Bankers Committee in Lagos, the vice president said there was need for regulators to create knowledge-based regulations that would help maximise the strengths and opportunities associated with block chain technology and also minimise the risks and threats associated with it.

According to him, Nigeria needs to prepare for the shift to block chain technology and embrace technology for the nation’s developmental process.

“We must move Nigeria digital economy into global drive. Nigeria ICT is making giant strides. We have a lot; we must build softwares. As a nation, we have to embrace technology for our developmental processes,” he said.

Stakeholders at the summit also noted that for the country’s economy to record sustainable growth and reduce exposure to volatility in commodity prices, there was need to focus more on the provision of accommodative monetary policy measures that would enable faster recovery of the economy through improved flow of credit to households and businesses in key sectors of the economy, especially agriculture, ICT and manufacturing.

CBN Governor, Godwin Emefiele, said while accommodative monetary policy measures that would support growth remain its priorities for 2021, the apex bank would continue to pay attention to trends in inflation because price stability was critical to guiding savings and investment decisions by households and businesses.

According to him, the agricultural sector was a key driver in taking the Nigerian economy away from negative growth in the fourth quarter of 2020, stressing the need to sustain measures aimed at increasing productivity of the sector and increase production of locally made goods in the country.

In addition, he stressed the need for government to seek alternative ways of funding infrastructure to generate more revenue and enhance sustained growth, noting that a well-built infrastructure system could have a multiplier effect on growth by enabling the expansion of business activities in the country.

To this effect, he said the Infrastructure Corporation of Nigeria Limited (InfraCorp), a vehicle that would enable the use of private and public capital to support infrastructure investment, would become fully operational by the second quarter of 2021.

He said the company, Infra-Co, would be one of the top infrastructure finance entities in Africa and would be wholly dedicated to Nigeria’s infrastructure development.

He added that Infra-Co would operate as a public-private partnership and would be initially funded by the CBN, the Nigerian Sovereign Investment Authority and the Africa Finance Corporation.

According to him, it would focus on developing public assets and reconstruction as well as new roads, rail, power and other key infrastructure sector projects.

Minister of Finance, Mrs. Zainab Ahmed, said the banking sector plays a critical role in terms of reforms to reposition the country to effectively impact on different sectors of the economy to generate more revenue.

She, however, noted that the impact of the banking system on the rest of the economy depends on how it mobilises savings, allocates the savings, monitors the use of the funds by firms and individuals, pools and diversifies risk, including liquidity risk and eases the exchange of goods and services.

“When the banking system performs well, it tends to promote growth and expand economic opportunities. Economic growth is about enhancing the productive capacity of an economy.

“This is achieved by using available resources to reduce risks, remove impediments which otherwise could increase costs of doing business and hinder investment,” she said.