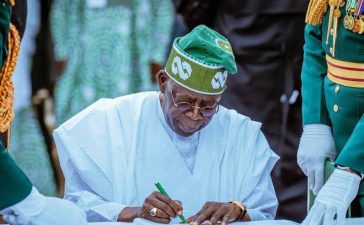

Foreign portfolio investors (FPIs) have made a remarkable comeback to Nigeria’s stock market, increasing their stake by an impressive 338.72 percent in May 2023. This surge in investment is believed to be driven by optimism surrounding the economic direction of President Bola Tinubu’s new administration, which was inaugurated at the end of the month.

Previously, there had been concerns about the dwindling presence of foreign portfolio investments in the market, with FPIs holding a mere four percent stake by the end of April 2023. These investors faced numerous challenges, including difficulties related to foreign exchange and repatriation of funds. In April, their investments had declined by 7.83 percent to N8.47 billion compared to N9.19 billion in March 2023, indicating a significant pullback.

Over the past seven years, foreign investors had steadily reduced their stake in the market. However, the trend shifted dramatically in May, as FPIs increased their investment to N37.16 billion, a significant 338.72 percent surge from April’s figure, according to the Nigerian Exchange Limited (NGX) report on Domestic and Foreign Portfolio Investors’ Participation in Equity for May.

The new FPI position now accounts for 11.5 percent of the total equity transactions during the month, representing a substantial 7.07 percentage point increase from their previous total transaction of 4.43 percent in April.

This resurgence of foreign portfolio investors signifies renewed confidence in the Nigerian economy and its prospects under the new administration. It suggests that these investors are betting on positive economic developments and reforms that may be implemented by President Bola Tinubu’s government.

The return of FPIs to the Nigerian stock market is encouraging for the overall investment climate in the country. Their increased participation brings additional liquidity, enhances market stability, and boosts investor confidence. It also reflects Nigeria’s attractiveness as an investment destination, potentially attracting more foreign capital in the future.

However, Experts say it is essential to monitor the sustainability of this positive trend and address any lingering challenges that may still hinder foreign investors’ participation as continued efforts to improve foreign exchange liquidity, ease repatriation processes, and provide a favorable regulatory environment will be crucial in maintaining and expanding foreign portfolio investments in the Nigerian market.