Global Selloff Deepens as Trump’s Tariff Measures Shake Markets

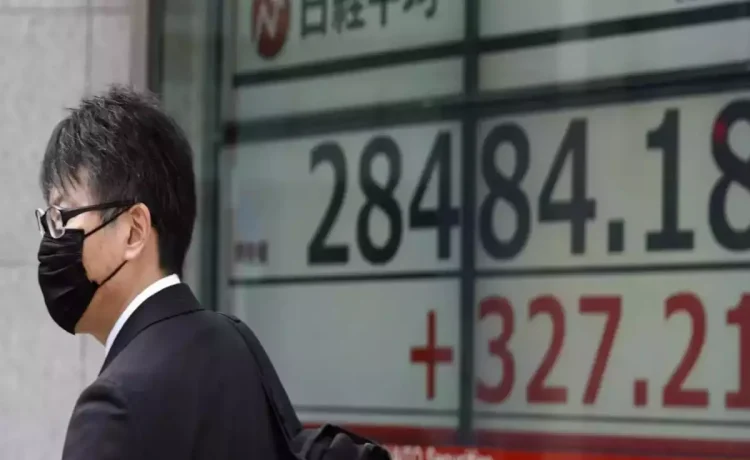

Asian shares plunged to their lowest levels in two months, continuing a global stock market selloff sparked by President Donald Trump’s latest tariff measures. The fallout from the tariffs sent investors flocking to safe-haven assets, while stocks across the globe, including in the US, saw massive losses. Japanese shares hit their lowest point since August, and bond yields tumbled, reflecting the growing economic uncertainty.

On Thursday, US stocks took a heavy hit, with $2.5 trillion wiped off their value. The S&P 500 and the Nasdaq 100 experienced their largest drops since 2020, adding to concerns about economic stability. Equity-index futures for both the US and Europe also pointed to further declines.

US Dollar and Global Bonds Weaken

The US dollar continued its slide on Friday, while the yields on the 10-year US Treasury hovered near the critical 4% mark. The global junk bond market also weakened significantly, posting its largest decline since March 2020.

The main factor behind the turmoil is the reversal of the “America-first” trade strategy, where investors had previously favored US assets. Now, concerns are mounting that Trump’s aggressive tariff hikes, the steepest in a century, could severely impact economic growth both in the US and globally.

Market Volatility Ahead of US Jobs Report and Fed Speech

The global selloff comes at a tense time, with Friday’s US jobs report and an important speech by Federal Reserve Chair Jerome Powell looming. Investors are anxiously awaiting these developments, which could set the tone for markets already jittery about the outlook for the world’s largest economy.