As urbanization continues to reshape Africa, experts emphasize the critical role of financing in ensuring the productivity, livability, and sustainability of the continent’s cities. Authors of a recent study stress the need for cities to play the finance game strategically, capitalizing on available options that can be influenced locally. However, they highlight the prerequisite of strong support from national governments to enhance revenue collection and facilitate financial growth.

Drawing inspiration from successful financial mobilization strategies in Mexico and the Philippines, the study underscores the importance of tapping into domestic markets for finance rather than solely relying on external sources. Key to this approach are reforms aimed at developing financial instruments such as credit ratings. These reforms not only showcase the improvements cities are making but also help investors understand the investment opportunities available.

The authors argue that such financial reforms are entirely feasible for African countries, setting the stage for the continent’s development leading up to 2050. They emphasize the need for simultaneous efforts from both the public and private sectors, addressing both the supply and demand sides of financial markets. The goal is to ensure that Africa’s cities become not only places where citizens live but thriving hubs of productivity and sustainability.

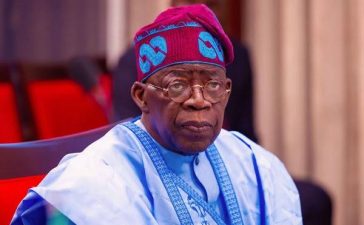

During a recent presentation, Akinwumi Adesina, President of the African Development Bank, echoed these sentiments, calling for greater emphasis on attracting private investment into cities. He outlined four key strategies to achieve this:

Greater Autonomy and Fiscal Responsibility: Granting cities and towns more autonomy and fiscal responsibility can empower them to manage their finances more effectively.

Debt Securities for Greater Financing: The use of debt securities can provide cities with additional financing options, supporting their development projects.

Improved Mortgage Financing: Developing better mortgage financing options can contribute to creating more livable cities with increased access to affordable housing.

Regulatory Space for Local Capital Markets: Providing additional regulatory space, including the issuance of municipal and green bonds, can enable cities to raise funds locally and enhance their financial independence.

Adesina emphasized the urgency of implementing these measures to attract private investment and ensure the sustainable growth of Africa’s cities. As the continent navigates the challenges and opportunities of urbanization, strategic financial planning and collaboration between governments and the private sector are deemed essential for success.