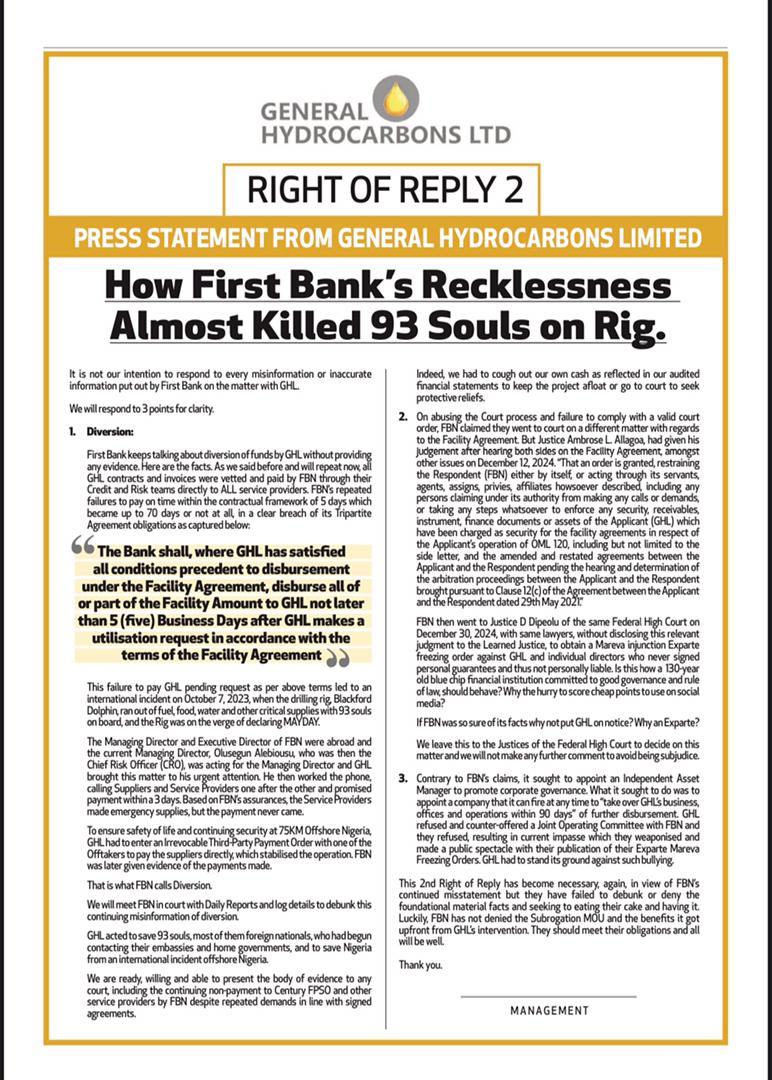

General Hydrocarbons Limited (GHL) has issued a detailed response to First Bank of Nigeria’s (FBN) recent statements regarding their ongoing legal dispute, specifically addressing three key points of contention.

GHL accused the bank of misinformation, negligence, and disregard for contractual obligations that led to a life-threatening incident on an offshore drilling rig.

In a scathing rebuttal, GHL clarified that contrary to FBN’s repeated claims of fund diversion, all contracts and invoices were vetted and paid by the bank directly to service providers.

However, GHL asserts that FBN failed to meet payment obligations within the stipulated five-day period, causing significant operational disruptions.

This included a life-threatening situation on October 7, 2023, when the Blackford Dolphin drilling rig ran out of fuel, food, water, and critical supplies.

With 93 crew members onboard, many of whom were foreign nationals, the rig was on the brink of declaring a “MAY DAY” emergency.

GHL claims that despite repeated assurances from FBN’s management, the bank failed to make timely payments. To prevent an international incident and ensure the safety of those on board, GHL had to step in and pay suppliers directly, stabilizing the operation.

GHL also addressed the court process, stating that FBN had acted improperly by obtaining an ex parte freezing order from Justice Dipeolu on December 30, 2024, without disclosing a previous ruling by Justice Ambrose L. Allagoa. This order, according to GHL, was sought inappropriately without proper notice and in violation of ongoing arbitration proceedings.

Lastly, GHL denied FBN’s claim that it rejected good governance by refusing the bank’s proposal to appoint an independent asset manager. GHL argued that FBN’s attempt was not about governance, but about taking control of GHL’s operations. GHL proposed a joint operating committee, which FBN allegedly refused, resulting in the current deadlock.

This latest response from GHL comes amid continued legal proceedings and emphasizes its commitment to defending its position in court, including debunking claims of fund diversion and corporate mismanagement.